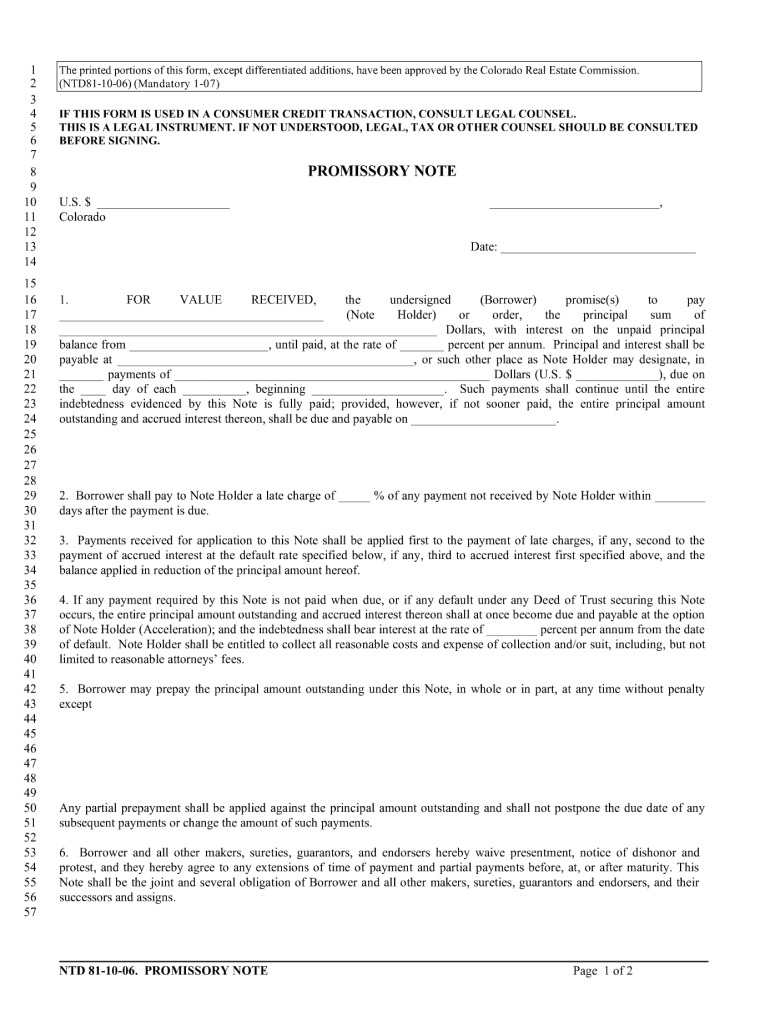

What is the purpose of the Form NTD 81-10-0 6 Promissory Note?

This promissory note is a legal instrument whereby the borrower promises to repay the principal amount of debt and the interest accrued thereon to the lender or note holder. The Colorado Real Estate Commission approved this form for use in the State of Colorado. If you use this form in a consumer credit transaction, you should consult your legal advisor.

Who fills the Form NTD 81-10-06?

A borrower that promises to pay for the value received fills the form. The borrower may be a natural person, corporation, or partnership.

What documents accompany the Form NTD 81-10-06?

The promissory note evidences the indebtedness secured by a Deed of Trust. The latter contains additional rights of the note holder, including the right to accelerate the debt.

When does the promissory note expire?

The promissory note remains in force until the borrower fully pays the indebtedness evidenced by the note. The borrower and the note holder agree the maturity date, which should be specified in section 1.

What information should be provided?

In section 1, the borrower provides the following information: name of the note holder; the principal sum and interest; address of the place where the payment is effected; the number and amount of payments to be made; payment schedule; and maturity date. In section 2, the borrower indicates the rate of late charge and when it is paid. The default interest should be provided in section 4. Section 5 contains conditions under which prepayment incurs penalties. In section 8, the borrower provides the date of the Deed of Trust and description of the property. In the last section, the borrower indicates his name, address, and signs and seals the document.

What do I do with the form after its completion?

The borrower delivers the promissory note to the note holder. The original of the note must be presented to the public trustee that releases the deed of trust securing the note. The note holder must keep the note in a safe place.